Funding Solutions

Unlike traditional loan brokers who try to choke clients with loans they have, we go in the market searching and matching a suitable funder for clients. Debt/Loans are one way to raise funds, we help clients with equity, hard money, government grants, or even consult on creative financing ways, whatever fits your situation.

Numerous old and new organizations will attempt to get an advance from a bank, however this is in many cases an exercise in futility. Alongside protecting your cash, banks watch a couple of insider facts. They, first and foremost, won’t let you know that the bigger they are, the more you should hang tight for everything, from meeting with a consultant to getting endorsement to getting the funding. Besides, assuming you apply for a credit at a bank you’ve worked with previously, you will not get any exceptional advantages for your dependability. Thirdly, banks frequently reject independent company credits on the grounds that the advances are anything but a beneficial monetary item for them.

Since huge number of good organizations can’t get the financing they need from a bank, many go to elective moneylenders and get cheated. At CFE, we stand behind our conviction that organizations should be dealt with better. You ought to have the option to get quick and direct supporting without overpaying.

Benefits With Us

$5,000 - $150,000

Get a small business loan that builds up your credit and opens up new possibilities.

Easy Application

qualify in minutes without visiting a branch or spending hours on paperwork.

Better Rates

Save up to 40-50% compared to a merchant cash advance and other online lenders.

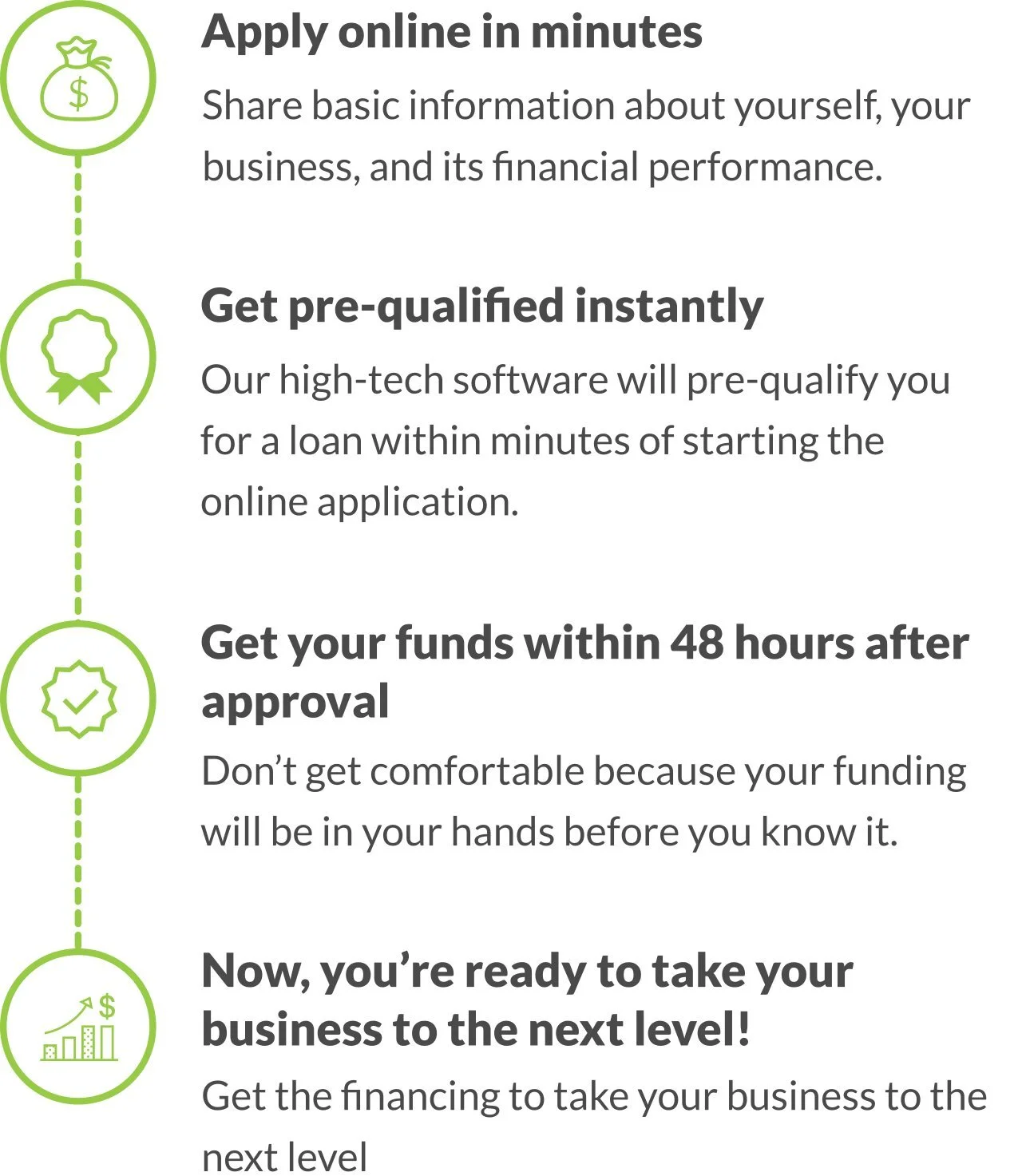

Process with us